To sell or not to sell?

For those of us in the aging collector demographic, our childhoods were spent dreaming of the vast fortunes that awaited us in adulthood as our cards grew in value like those from generations past. The reality turned out to be quite the opposite though, as our massive cardboard reserves are now barely worth the paper they’re printed on. Ever since that harsh reality set in, collectors have struggled with the decision of what to do with hot cards they pull from packs. Sell for the quick cash? Wait and see for a little while and dump at the first sign of a downturn? Or hold on for the long haul and hope for a big return in the far future? My take is that you shouldn’t worry about it much, just keep what you like and sell off anything else that has value. Live in the now and let someone else take on the risk. But how has that worked out for me over the last 15+ years?

For those of us in the aging collector demographic, our childhoods were spent dreaming of the vast fortunes that awaited us in adulthood as our cards grew in value like those from generations past. The reality turned out to be quite the opposite though, as our massive cardboard reserves are now barely worth the paper they’re printed on. Ever since that harsh reality set in, collectors have struggled with the decision of what to do with hot cards they pull from packs. Sell for the quick cash? Wait and see for a little while and dump at the first sign of a downturn? Or hold on for the long haul and hope for a big return in the far future? My take is that you shouldn’t worry about it much, just keep what you like and sell off anything else that has value. Live in the now and let someone else take on the risk. But how has that worked out for me over the last 15+ years?

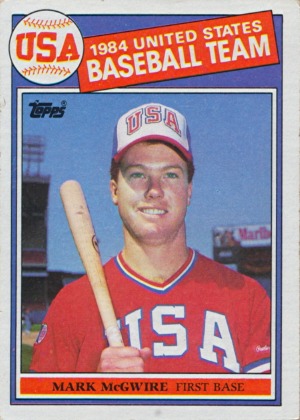

My first big score went unnoticed for nearly a decade. Back in my first year of collecting, I pulled a Mark McGwire rookie card. These days, such a card wouldn’t even be allowed in a base set, but back then it counted as a legitimate rookie. By the time it was worth anything, it was in such terrible condition that it wasn’t. But it was mine and I treasured it. At the card’s peak following the 1998 home run record chase, I overheard someone trying to sell one at a card show without much success. Despite the card’s popularity, its actual value in terms of what a dealer would pay just wasn’t that much. Only cards in top condition (which would be sent in for grading these days) would sell for book value; anything else would sell closer to half book. Factor in a dealer’s overhead and profit margin and you can expect the maximum buying price to be half of the selling price. Even for a $80-120 card, you would be lucky to walk away with $20 from a dealer. Cashing in on a hot card wasn’t that easy in the days before online sales were the norm.

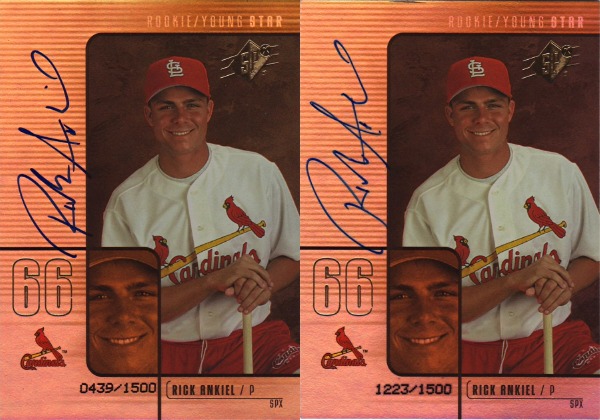

I got back into collecting in 2000 after a few years away and immediately started racking up big hits. And I kept all of them. Most notable here were the two Rick Ankiel SPX autographs I pulled from packs from the same store. At the time, these were selling for up to $80 despite not being rookie cards (his RC year is 1999). Still, he was one of the hottest rookies in baseball and his future looked bright.

Until he imploded in the postseason.

Today, these cards are worth $10 on a good day. Ankiel would later play for the Mets, so these now qualify for my collection. But that still doesn’t make holding on to them the best choice. I had no interest in Rick Ankiel at the time, but I liked having valuable cards. After a few months of that though, I realized that there was more to collecting than hoarding things that other people wanted. I needed to figure out what I wanted.

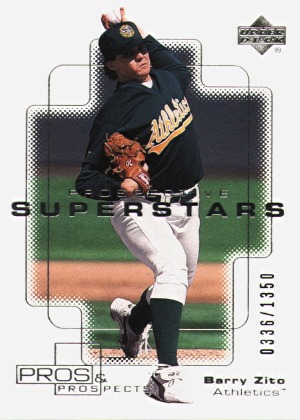

Barry Zito wasn’t it. His rookie cards were hot in 2000, so much so that this card, numbered to a mere 1350, was considered a big hit. When I pulled it from a box of 2000 UD Pros and Prospects, I called the owner of the shop I bought it from to get his opinion. I knew nothing about prospects at the time and the network of online resources we have today simply didn’t exist back then. I relied on people I knew from face-to-face interactions for their opinions. Strange, I know. He said that the card was a big deal and I immediately put it up on eBay. It was the second one to sell and went for $106.63, which would rank as my biggest sale for almost 12 years. These days, this card is only worth the nostalgia for when Zito was poised to be a dominant pitcher for years to come.

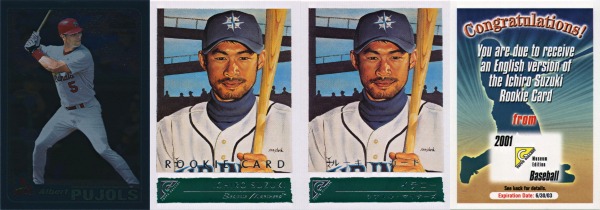

Not all rookies flame out spectacularly though. 2001 brought us a rare dual trifecta – a pair of Rookies of the Year with rookie cards issued in the same year who would go on to have Hall of Fame caliber careers. That sort of thing just doesn’t happen, and yet it did with Albert Pujols and Ichiro (Suzuki). Even at the time, these two seemed destined for greatness, though we’ve said that about a lot of players who fall short… But what to do with their rookie cards?

I was at a crossroads in my collecting when these rookie cards hit. I had worked up to buying one case of each base Topps and Upper Deck release and boxes of many others in search of the elusive big hit. But as the big hits got smaller, I tired of the sport and the inevitable dozens of eBay auctions that would follow. My days as a case breaker were numbered. Near the end though, I had no shortage of Ichiro and Pujols rookie cards. Some luck with 2001 Topps Chrome Series 2 got me the foil Pujols, while a half case of 2001 Topps Gallery yielded one Pujols and three Ichiro redemptions, two English and one Japanese. On top of that, a case of 2001 Topps Series 2, one of 2001 Upper Deck Series 2, and several boxes of 2001 Topps Traded had me loaded with both of their rookie cards. With so much money tied up in these products, I had to get some value out of these guys…

I was at a crossroads in my collecting when these rookie cards hit. I had worked up to buying one case of each base Topps and Upper Deck release and boxes of many others in search of the elusive big hit. But as the big hits got smaller, I tired of the sport and the inevitable dozens of eBay auctions that would follow. My days as a case breaker were numbered. Near the end though, I had no shortage of Ichiro and Pujols rookie cards. Some luck with 2001 Topps Chrome Series 2 got me the foil Pujols, while a half case of 2001 Topps Gallery yielded one Pujols and three Ichiro redemptions, two English and one Japanese. On top of that, a case of 2001 Topps Series 2, one of 2001 Upper Deck Series 2, and several boxes of 2001 Topps Traded had me loaded with both of their rookie cards. With so much money tied up in these products, I had to get some value out of these guys…

But I also wanted some to keep. And so I kept one of each for myself while selling off what I could. The Gallery Ichiro redemption went for $37.66, less than I was hoping for but still more than his Topps Series 2 card, which sold in the $7-12 range. Upper Deck Series 2 sets initially sold well at $35 but soon fell to less than half that, way too low for a set with both rookie cards. Topps Traded did about as well with sets selling for $40 initially, but the one extra Pujols I had only brought in $5. At their peak, Pujols rookies would book for $50 and copies good enough to be graded sold fairly close to that. These days though, even after reaching the 3,000 hit milestone, the Ichiro Gallery cards only sell for about $5 while most ungraded Pujols RCs only go for $10-20. Sometimes timing is everything.

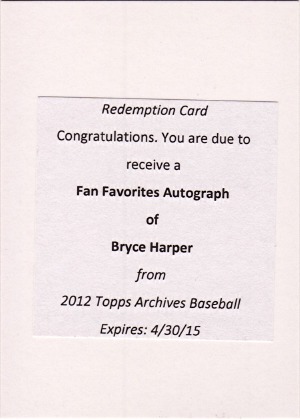

And then there’s Bryce Harper, #1 draft pick, Rookie of the Year, and 2015 NL MVP. He entered the spotlight as a rare sure-thing top pick, rarer still because he actually delivered. Topps rushed out his first Rookie Cards as short prints in 2012 Topps Archives, with autographed versions issued as redemptions. As a Mets fan and the holder of several Topps redemptions (some of which have yet to be fulfilled even now), I had no desire to keep this card when I pulled it from one of the six boxes I opened. After briefly considering waiting to get it redeemed before selling, I opted to cash out immediately. But instead of putting it up right away on a 1-day auction, I played it safe and listed it as a 3-day auction the next night. The first copies sold for up to $500, but mine went for a disappointing $317. Did I just make a huge mistake?

Yes and no. Harper would go on to have a few big seasons and certainly looks to be at the peak of his popularity (possibly even beginning his decline at the ripe old age of 24). Could he keep getting better? Maybe, but is there anywhere else for his card prices to go? There are always younger, shinier prospects to latch on to and newer super premium cards to chase. Harper’s 2012 Archives autographs, long since redeemed, have sold in recent years for up to $600, with some going for less than $350; recent Gem Mint graded copies have sold for about $450, suggesting that the $350 mark is still about right. That’s still more than what I sold it for, but if $35 was the cost of passing on the risk to someone else, I’ll take it.

I got lucky by accidentally holding off on selling this Byron Buxton prospect autograph from 2013 Bowman’s blue wave refractor redemption packs. Buxton was a big deal in 2013, but by September he was the consensus #1 prospect. Coincidentally, it was in September that I uncovered this card, having directed two wrapper redemption packs to my brother because I had put in for the maximum of 10 packs at my address. When those 10 packs never showed, I gave up on the other two and forgot about the whole thing. Until September. I wasted no (more) time selling off one of the hottest cards of the hottest prospect in baseball and got $394.77 (minus fees) for my efforts. I was hoping for $500, but instead I had to settle for my biggest single eBay sale ever.

Buxton remained at the top of the top prospect lists until he lost his eligibility. His time in the majors however has not gone as planned. He’s still young, so his card prices are only about 25-50% down from 2013. Still, he’s not looking like a good long-term investment at those initial prices.

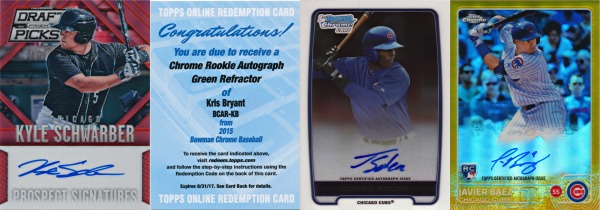

There isn’t much hotter than the Chicago Cubs right now. Fresh off a thrilling World Series win after 108 years without a title, the Cubs and their young stars are today’s top collecting target. I’ve been lucky enough to pull autographs from four of the players on the 2016 World Series champion team over the last few years and have about $350 and a Kyle Schwarber autograph to show for it. Can’t complain about that.

There isn’t much hotter than the Chicago Cubs right now. Fresh off a thrilling World Series win after 108 years without a title, the Cubs and their young stars are today’s top collecting target. I’ve been lucky enough to pull autographs from four of the players on the 2016 World Series champion team over the last few years and have about $350 and a Kyle Schwarber autograph to show for it. Can’t complain about that.

The Schwarber never got sold because I pulled it over a year after its release from a clearance box of 2014 Panini Prizm Perennial Draft Picks. Numbered to 100, this red parallel looks great despite the usual Panini photoshop treatment. By the end of 2015 though, it was only selling for about $30, not enough to get me to part with it. It’s still at the same price a year later, so I might be holding on to this one for a while. Get well soon, Kyle.

The Kris Bryant is the obvious big hit of the bunch, selling for $252.49 just a day after I pulled it; I wasn’t going to make the same misteke I made with the Harper redemption three years earlier. I had been hoping for something closer to the $300 that some of his 2015 Topps Chrome green refractor RC autographs had been selling for, but I was fine with $250. Until three more sold the next day for at least $300 each. You just can’t win sometimes.

One year, Rookie of the Year, a World Series title, and an NL MVP award later, the redeemed version of this card was still selling in the $250-300 range, with Mint graded copies selling for $350. Things went about as well as you could hope for with Kris Bryant over that span, but his card prices didn’t budge one bit. What gives? This is one of the dirty little secrets of dealing with prospects and rookies – just about all of the room for improvement is already baked into the initial prices due to speculators who are willing to take smaller and smaller profits regardless of the risk. The more hype a player has at their start, the smaller the chances are of any rise in prices over time. And if they don’t end up in the discussion for best player in baseball, expect prices to fall. As with stocks, today’s prices are based on expectations for future performance, not actual present day value.

Jorge Soler is a good example of when things don’t go according to plan. As the big name in 2012 Bowman Chrome, this card sold for $47.66 shortly after the product was released. With Soler reduced to a replacement-level player though, this card is now worth barely half that (which is still more than you would expect considering that the equivalent Billy Hamilton, that product’s other big name, is selling for about $5 on a bad day).

On the other side of things is postseason hero Javier Baez. Picked 9th overall in 2011, Baez was fairly highly regarded when his first Rookie Cards came out, so much so that the $46.09 that this gold refractor autograph sold for seemed a bit disappointing. After being named NLCS MVP, the most recent ones to sell went for $150. I was just happy to get something good out of retail, but I sure missed the boat on this one…

Overall though, this bunch went from being worth about $380 when I got them to being worth about $450 today. That’s after one World Series title, one NLCS MVP, and one Rookie of the Year/NL MVP. I regret nothing because I’ve been following one simple course of action: do whatever seems right at the time and move on.

And that’s about all the advice I have from 30+ years of collecting. High dollar cards of hot rookies and prospects come with huge risk, so keeping (or buying) them for investment purposes seems like a bad idea. But if it’s something you like? Hang on to it and enjoy the ride.

Comments are closed.